Precious metal IRA: How it works

.jpg)

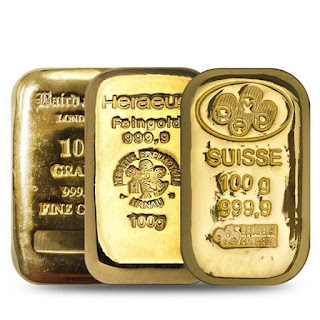

Before diving into the benefits and disadvantages linked with Precious metal IRA details, it’s important to first get to know a few things. First, what is IRA, and what purpose it serves in an investor’s retirement case? A gold IRA is a single retirement investment in which some level of its part is in real gold. To team up as a gold IRA, these records can't hold paper-based gold resources alone (i.e., mining stocks or ETFs) — rather, they should include actual bullion like gold bars or sovereign-minted coins. Why Precious Gold IRA? Like all IRAs, gold IRAs give tax cuts to their owners. Customary gold IRAs comprise pre-charge resources for which tax collection is approved until withdrawal, though Roth IRAs are combined with after-charge resources which develop tax-free. Resources held within a Roth IRA are liberated from long-haul capital increases charges, while traditional IRAs are deducted upon store but charged at withdrawal. These tax breaks attract valuable metals a...

.jpg)

.jpg)

.jpg)