Investing in gold bullion: A valuable choice

Valuable metals, particularly gold and silver, can frame part of an expanded portfolio to furnish financial investors with support against unpredictable stock costs as well as low loan fees and security yields. There are one or two different ways of purchasing gold and silver as a venture, from buying actual bullion to Gold Gate Capital and exchanging ETFs and CFDs.

Why invest in

valuable metals?

Gold and silver bullion and coins have been utilized

as money all over the planet for millennia and keep on holding esteem as a

store of riches.

In the eighteenth and nineteenth hundreds of years,

different nations utilized either gold or silver guidelines, fixing their

monetary forms to a decent measure of metals or to different monetary forms

like the English pound or US dollar that utilized the principles.

Notwithstanding, the yellow metal keeps on being seen as true cash,

considerably more so than silver, which likewise has modern applications.

Worries about the inflationary impacts of financial

improvement have brought about record inflows into gold and silver assets, as

financial investors try to save the worth of their capital and progressively

take a gander at how to look at silver price chart, gold, and other valuable metals.

The most

effective method to Invest in Actual Gold

Investing into actual gold can be trying for

financial investors more acquainted with exchanging stocks and bonds on the

web. With regards to actual gold, you'll for the most part be communicating

with sellers beyond conventional businesses, and you'll probably have to pay

for capacity and get protection for your venture. The three fundamental choices

to invest in actual gold are bullion, coins, and gems.

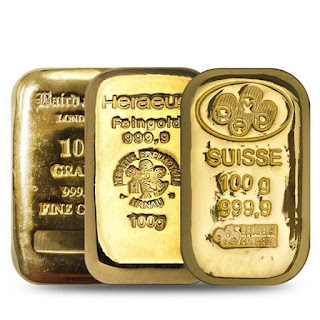

Gold Bullion

At the point when the vast majority contemplates

investing in gold, bullion is their thought process of — enormous, glossy gold

bars locked away in a vault.

Gold bullion comes in bars going from a couple of

grams to 400 ounces, yet it's generally normally accessible as a one-and

10-ounce bar. Considering that the ongoing gold cost is around $1,900 per ounce

this makes investing in gold bullion

a costly recommendation. What's more, not normal for stocks, it's impossible to

get a fragmentary portion of a gold bar.

Would it be

advisable for you to Invest in Gold?

Assuming you're worried about expansion and

different disasters, gold might offer you an effective money management place

of refuge. However in the more limited term, it tends to be similarly all

around as unstable as stocks, over the extremely long haul, gold has held its worth

surprisingly well.

Depending on your inclination and fitness for risk,

you might decide to invest in actual gold, gold stocks, gold ETFs and shared

reserves or speculative prospects and choices contracts. No matter what type of

gold you pick, most guides suggest you designate something like 10% of your

portfolio to it.

Any type of financial planning conveys chances. Gold

is the same. However, the particular gold market isn't excusing and consumes

most of the day to learn. This makes gold ETFs and shared reserves the most

secure decision for most financial investors hoping to add a portion of gold's

steadiness and shimmer to their portfolios.

.jpg)

.jpg)

Comments

Post a Comment